Insurance companies in 2024: sustainable, inclusive and digital – the values of change

Insurance companies in the DACH region are focusing on sustainability, customer loyalty, omnichannel communication, cyber security and social media.

This year, the DACH regions have performed much better than other countries. But when it comes to accessibility, they still have some catching up to do. Indeed, this is one area where insurance companies are performing worse than banks.

Detailed insights from 137 traditional insurance companies and neo-insurers based on 480 data points

Download the entire study as a PDF file and find out more about the analysis and benchmark report on 137 insurers.

- Detailed rankings

- Key lessons learned and background information

- Building blocks for the “ideal digital” insurance provider

Which topics are currently shaping the market?

In 2014, the insurance sector is facing an exciting paradigm shift where sustainability, inclusion and digitalisation are shaping the agenda of the future. Not only are these three values defining corporate strategies, they are also reflecting the changing expectations of customers and employees.

Cyber security plays a crucial role in the insurance sector and is also achieving above-average results compared to other dimensions.

The importance of cyber security varies widely within the insurance sector. While some companies consider it a strategic focus, others prefer to see it as an operative necessity. Nevertheless, the average score in this area is one of the strongest compared to other dimensions.

This topic is of vital importance to the insurance sector as it involves working with sensitive personal data. A high level of data protection is essential to gaining customer trust and ensuring the safety of policyholder data. Which regions place particular emphasis on this topic? Find out more in the report.

How prepared are companies to meet the new EU accessibility requirements?

The Accessibility Improvement Act (BFSG) will enter into force in 2025 and is gaining increasing traction with institutions. About 81% of insurance companies currently still have considerable room for improvement when it comes to ensuring the barrier-free design of their websites. This figure is even higher than in the private banking sector.

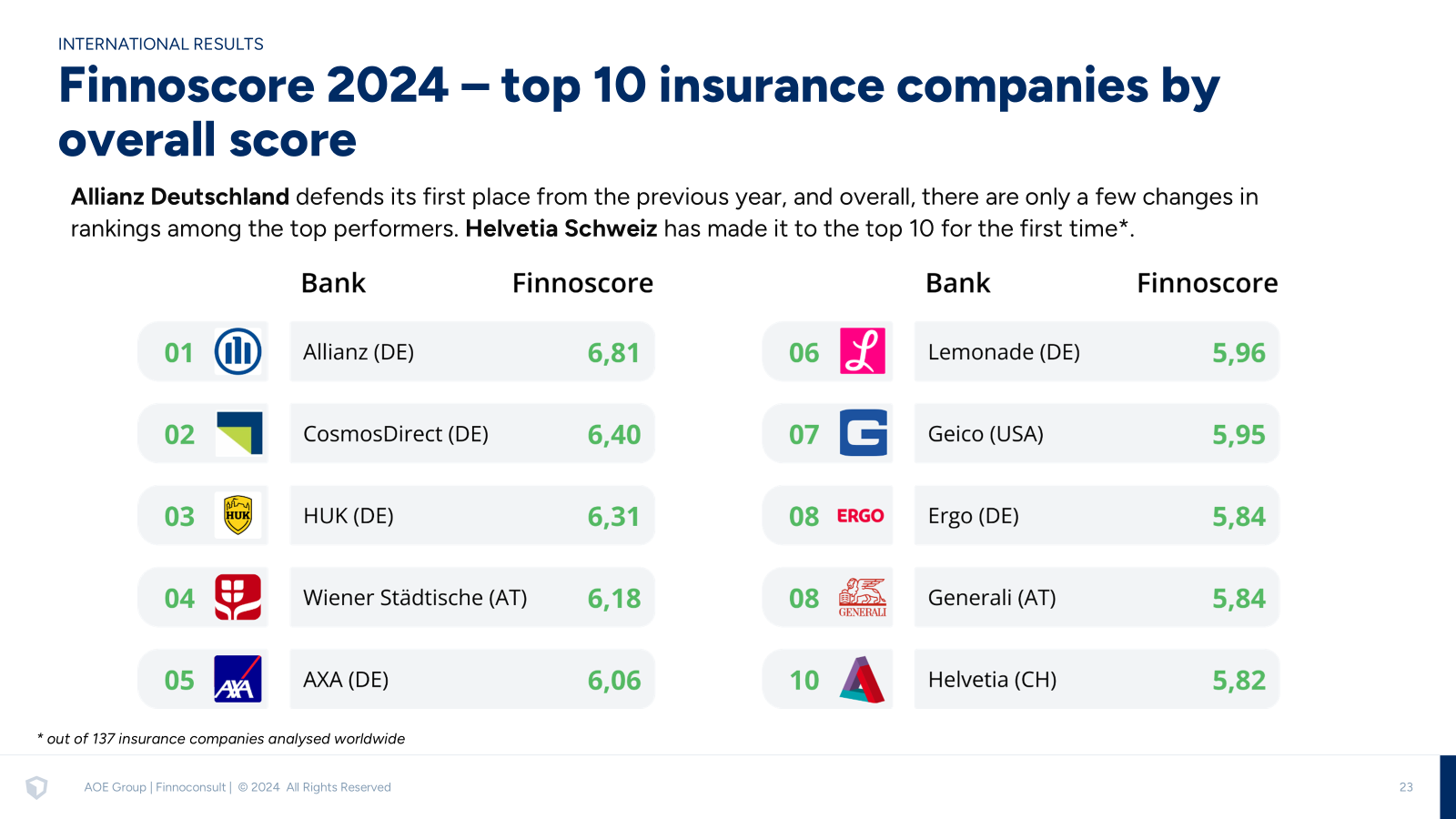

Top-performers of the year

Once again this year, companies from the DACH region claimed the top positions. Geico from the USA successfully defended its position in 7th place. Allianz Deutschland was particularly impressive and achieved outstanding results in the areas of cyber security, customer loyalty programmes with attractive advantages and an excellent website experience – all decisive factors for building and maintaining long-term customer relationships.

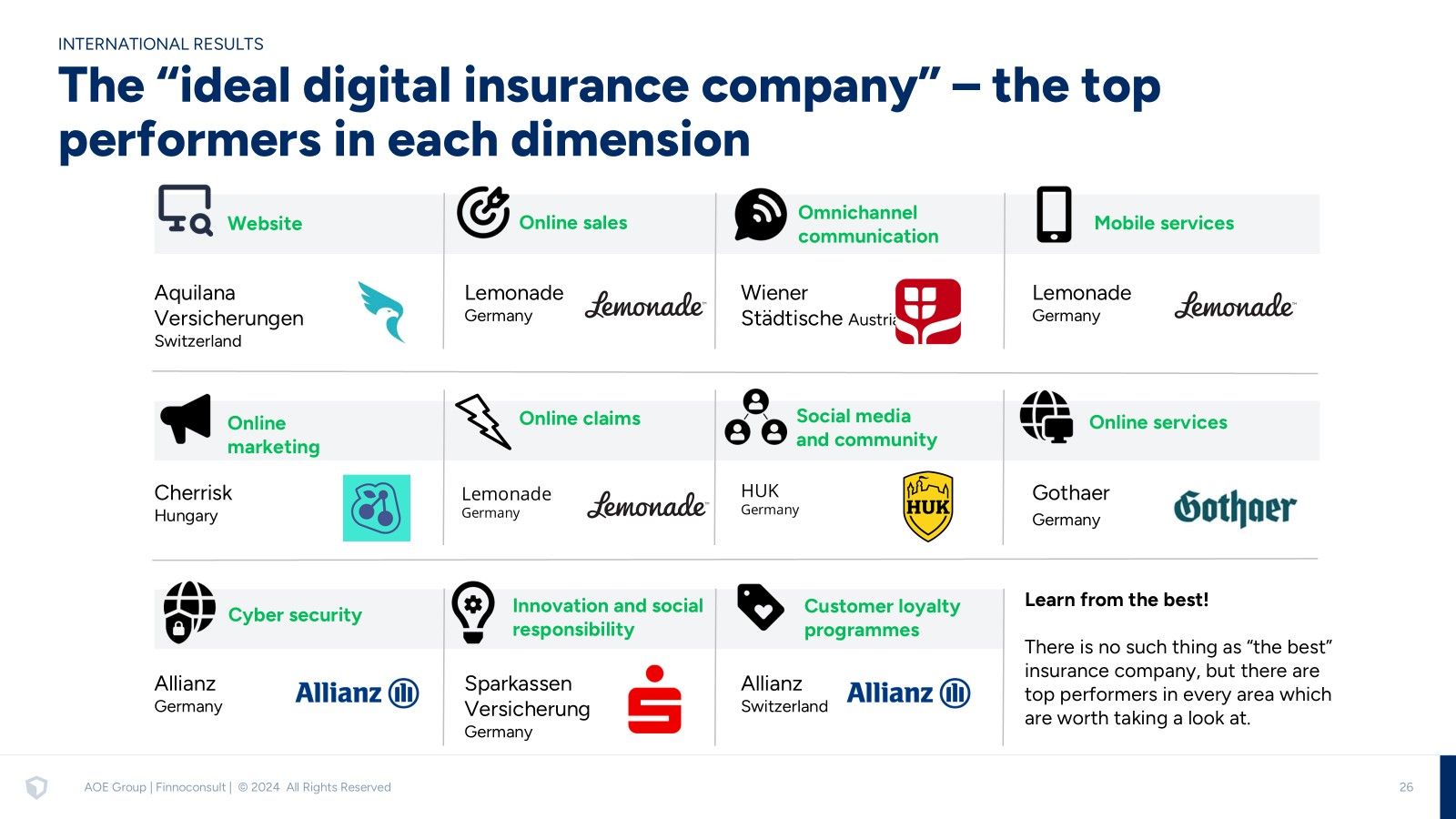

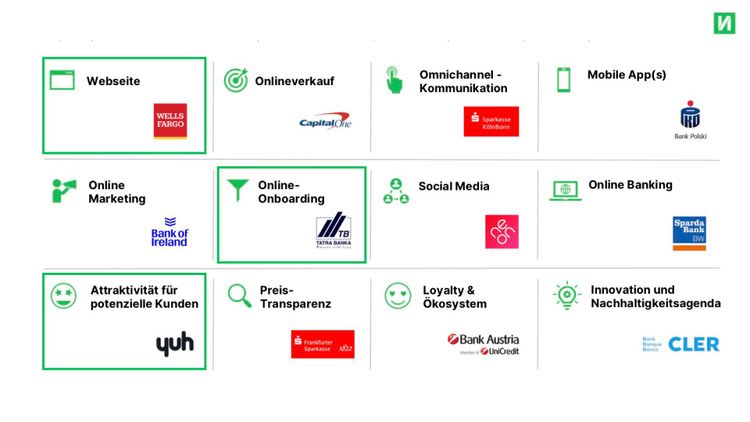

Which players are in the lead and in which areas?

Learn from the best and optimise your own performance and the digital experience of your customers. We have compiled a list of “ideal insurance companies” for you, highlighting the top performers in the individual dimensions of Finnoscore 2024:

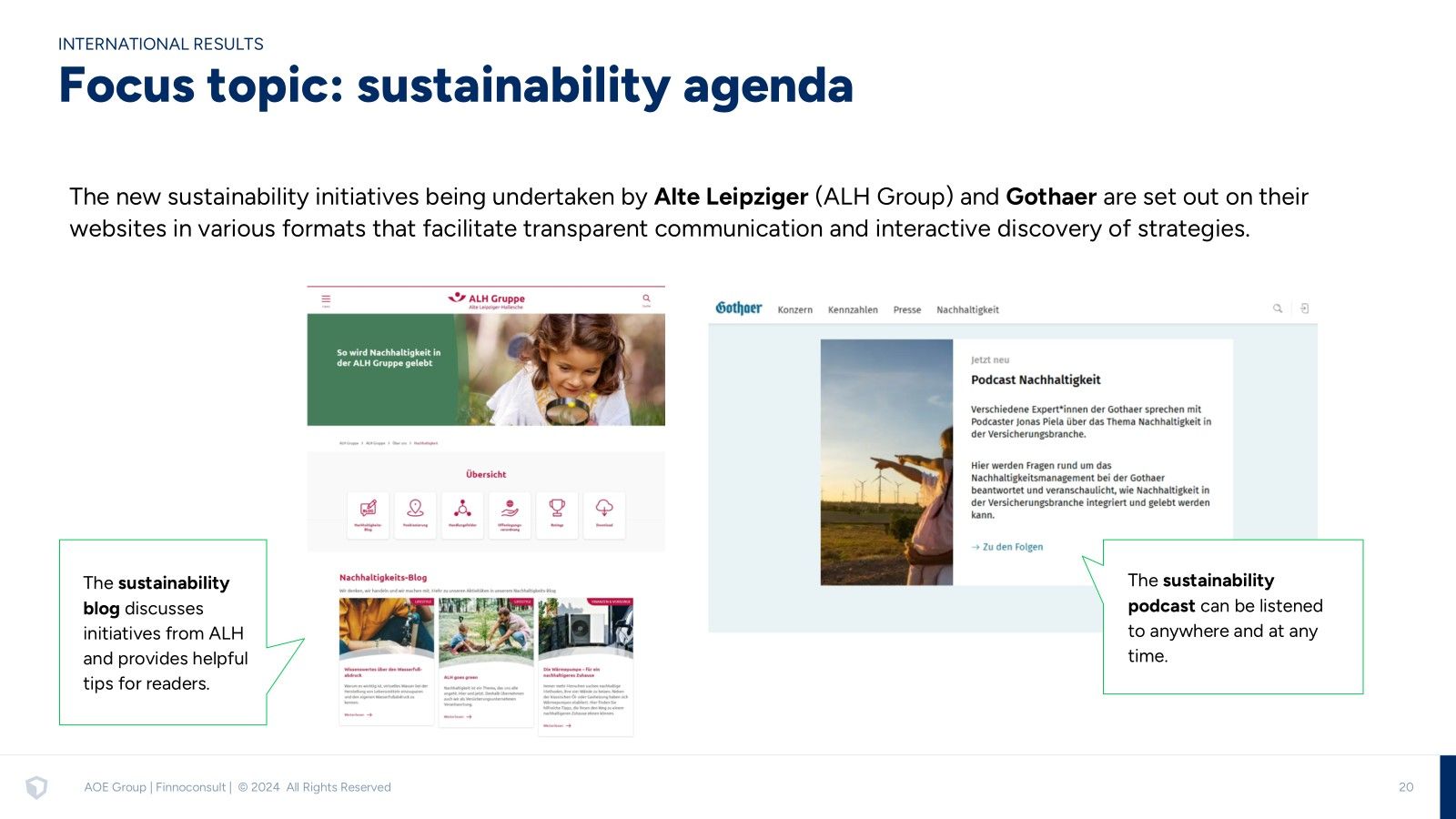

Focus topic: Measures to reduce the footprint are also becoming increasingly relevant in the insurance industry

The Corporate Social Responsibility (CSR) area is seeing positive developments, from the creation of sustainable products and training strategies to actively engaging employees.

Other Finnoscore analyses from the insurance sector

In a joint study with V.E.R.S. Leipzig GmbH as part of the InnoVario event, we carried out a comprehensive analysis of the year’s key findings on the digital customer experience in German insurance companies in 2024.

Find out more about the quality of the online presence of Swiss insurance companies in the extended “Digital Insurance Experience” study.

This study was conducted in collaboration with our partners: the Institute of Financial Services (IFZ) and Adnovum.

The analysis delivers in-depth insights into the areas of life, property and health insurance, both at well-established companies and at innovative startups. It also highlights the level of digitalisation, new technologies and current developments in the insurance sector. Together with Prof Florian Schreiber (Institute of financial services Zug IFZ), Martin Schachinger (Finnoconsult) and André B., Tecklenburg (Adnovum), we made sure to include valuable expert perspectives in this comprehensive analysis.

.jpg)