Beware! Neobanks! – What are you doing with the digital competition?

Why do neobanks grow so fast? And why do your customers like them so much?

Do you remember the way it was in the last millennium? Customers still had to go down to a branch to do their banking. But then smartphones came along and made services possible on the go. So banks developed phone banking in response and shortly afterwards mobile banking services came out. But in the beginning, all of the features were packaged in a way that was complicated and customers couldn’t use them in a meaningful way. Initially they had to waste a long time using the apps for a long time and that meant these apps were only used in case of emergency.

Neobanks such as N26 suddenly changed all that

All of a sudden, it became super easy to open an account. Using the app was much more customer-friendly. Thanks to a good user interface, everything could be done using a mobile phone. Nowadays, no-one has to go to a branch to open an account. It can be done at home in just a few minutes. A bank transfer should take no more than a few seconds and nobody wants to remember IBANs anymore.

Digital banks don’t need branches

That means they can afford to give away free offers and low fees even over the long term. This appeals to young people in particular. Initially, traditional banks were not so concerned about these new developments. They had other customer segments to worry about that were more profitable. These existing customers were traditional and needed multiple product categories. As they had no reason to switch to neobanks, everything still seemed to be rosy in the world of banking.

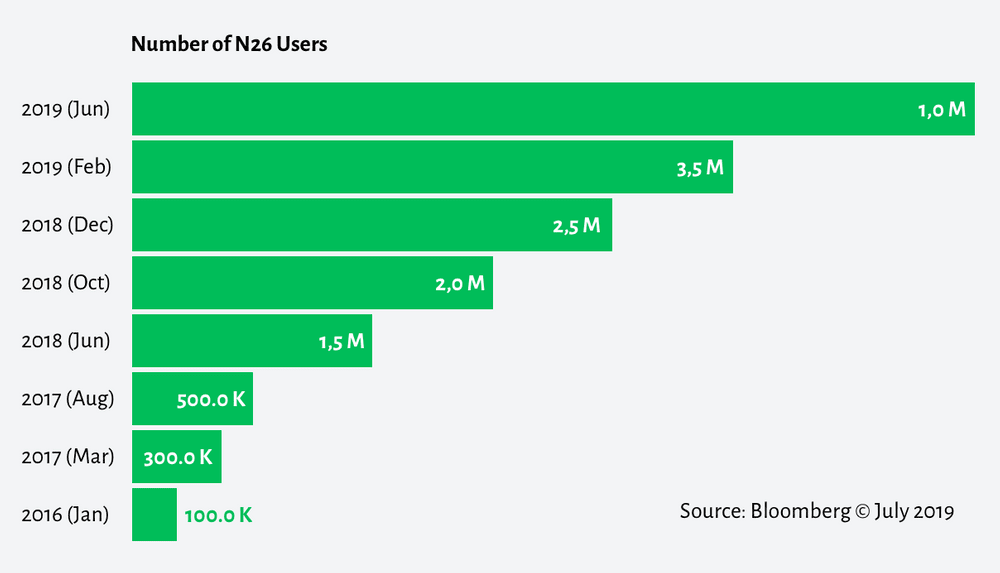

But in reality this development was dramatic:

- Most banks had to come to the realisation that their customers were too old. When their elderly customers passed away, they weren’t replaced by new customers because most young people preferred to go to neobanks.

- At the same time, neobanks also expanded their product range to include savings products and consumer loans. This greatly disrupted the core business of traditional banks and threatened their very existence. Neobanks were now also dangerous competitors as main banks.

- And finally, the coronavirus hit. All customers were suddenly forced to use mobile and online banking services, which actually proved much easier than expected. In recent months, you too will have noticed that most customers no longer need branches for banking transactions.

All of this has challenged the business model of traditional banks with branch networks and local support. Some banks noticed the signs on time and reacted in the right way. An example of this is Bank Cler from Switzerland. We’re proud to have supported Bank Cler in coming up with and launching the first mobile-only bank in Switzerland. The result: 9 months Time2Market and 18% customer growth in 22 months.

Nowadays, customers can switch banks extremely easy

This way customer loyalty is becoming increasingly important. It’s no longer enough for banks to just provide good banking products. They must also offer customers additional benefits. This poses a new challenge for banks: They must create an “ecosystem” of partners that provides a competitive advantage. It’s not so easy for neobanks to copy this. This was also the strategy of the Sparda banks in Germany. TEO was born along with our support: The first Lifestyle Banking in Germany. TEO is already used by more than three million customers. Teo has positioned the Sparda banks as digital leaders in Europe.

All that being said though, neobanks don’t just appeal to private customers - they’re also increasingly taking care of SMEs

We’ve reported on this in the past with the blogpost What are banks and fintechs doing for their self-employed and SME customers during the coronavirus crisis. Traditional banks are not meeting the needs of SMEs and freelancers. Instead, they specialise in private customers and large companies, and SMEs are largely forgotten about. Neobanks are taking advantage of this by rolling out new offers all the time – and customers are happy to make the switch.

In the meantime, most traditional banks have recognised the problem: They know they have to seriously invest in digital services for private customers and SMEs. This is the only way they’re going to be able to stand up to neobanks. Many have already allocated huge budgets for this. But that on its own is not enough since banks’ traditional systems are difficult to adapt. The entire management must stand behind this banking transformation and support it. Some banks have made this transition. Others have invested a lot of money and yet still couldn’t even maintain their market share. Especially during times of crisis, competence and experience are more important than ever.

Are you also thinking about improving your digital offer?

Do you want to lead your company safely into the future?

Are you looking for a competent consultant who you can talk through your innovations with?

Get in touch with us. Thanks to our competence and experience, we are the right partner to support you on the path into the future. Together we will find the best solution for your bank and your customers.

.jpg)