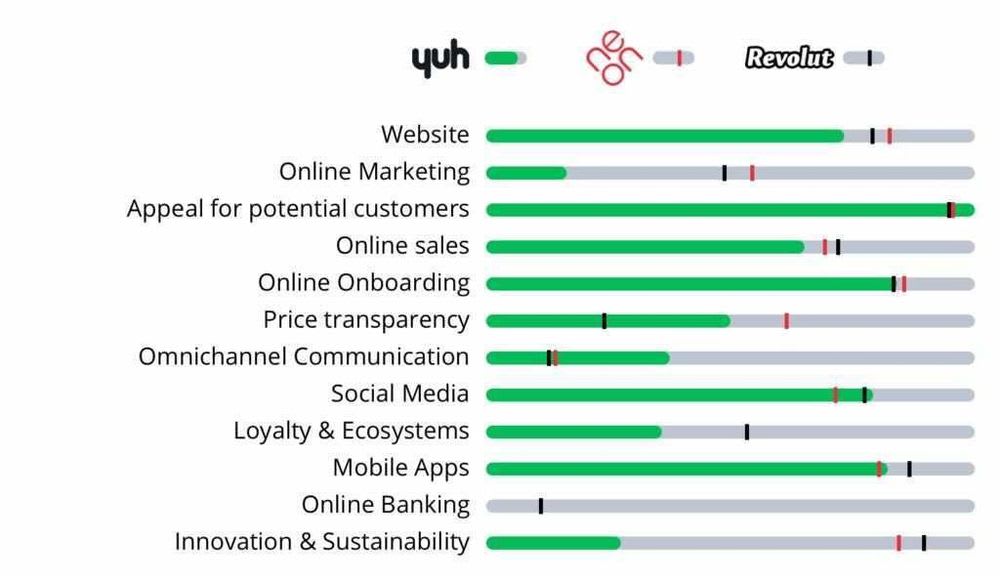

10,000 new customers in a few weeks – how well can Yuh already compete with established neobanks?

The Finnoscore reveals what this newcomer can do and how it stacks up against the competition.

Today we want to use the Finnoscore to take a closer look at one of the most exciting newcomers in the neobanking sector:

Two established Swiss players, the tradition-steeped Postfinance and the innovative Swissquote haven’t announced technical innovations for the long term, as is usual in the D.A.CH. region, but have put their money where their mouth is. After a 7-month development period, on 11 May 2021 they launched Yuh, a financial app that can already compete with established neobanks in a number of key aspects. Yuh offers paying, saving and investing from a single source and has opted for a low-to-no-fee strategy.

The Yuh app has just come onto the market. It is actually still an MVP (Minimum Viable Product), but for all that, it’s already quite complete. According to the app, it has already attracted 10,000 customers in its first few weeks. What’s the reason behind the success of Yuh? The Finnoscore gives us answers to that:

The focus is on acquiring new customers, and it’s convincing:

- Yuh’s website focuses mainly on new customers.

- The new feature for Switzerland is that it’s available in 11 countries!

- The advantages of the product are clearly presented and the low-to-no-fee concept is appealing to customers.

As an app, Yuh offers a number of attractive features:

- The learning platform YuhLearn (but at the moment it only works one-way as an editorial tutorial without interaction).

- A first for Switzerland, is the access to 13 cryptocurrencies.

- Investments can be filtered according to the user's own preferences (sustainability, ethics).

Yuh already has smart mechanisms for customer loyalty and engagement:

- The attractive, innovative customer loyalty programme based on Swissquoins rewards payments, investments and recommendations.

- The points earned can be used as cashback, donated to other customers or saved in the hope of an increase in value.

- Both the quality and speed of the response to enquiries are excellent: after 2 hours, there was a callback with topic-related answers without sales talk. The first impression for potential clients is very positive.

Onboarding works (as with Revolut and Neon) without video identification:

- Consequently, Yuh is already entering the second phase of digital onboarding.

- Customers only need scans of an ID and a confirmation of residence. But this can also be an electricity or mobile phone bill for the address specified.

Of course, there’s room for improvement:

- The chatbot Yulia still isn’t very practical: you can’t be directly forwarded from it to agents in the service centre. For customers, a telephone number is displayed for questions about the account, but this number doesn’t appear in the Contact menu item. This means that potential customers aren’t able to speak to an agent.

- A demo version of the app on the website is missing, and the onboarding process is not described in detail – you have to download the app for that. Two quick wins here could attract even more new customers.

- There is no desktop version of Yuh, but only the application on mobile devices. This is a disadvantage with the not-quite-young target group, who still don’t want to or can’t carry out all transactions with their mobile phones.

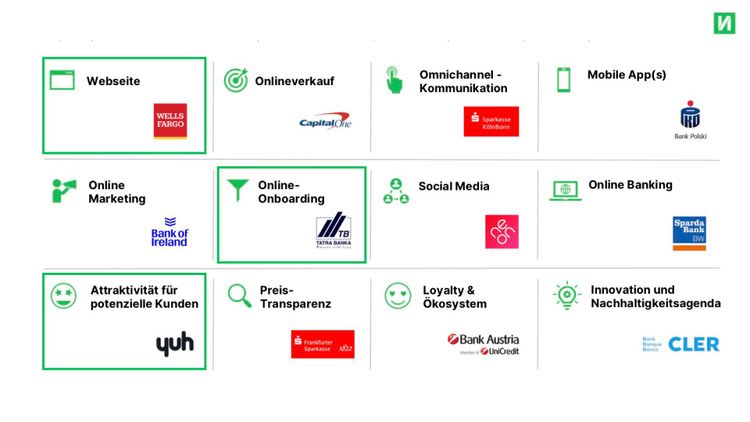

Don't want to be overtaken by newcomers like Yuh?

The Finnoscore shows you where your strengths and weaknesses lie and helps you stay ahead of the competition with quick wins and longer-term strategies. Get in touch with us.

Thanks to our competence and experience, we are the right partner to support you on the path into the future. Together we will find the best solution for your bank and your customers.

.jpg)