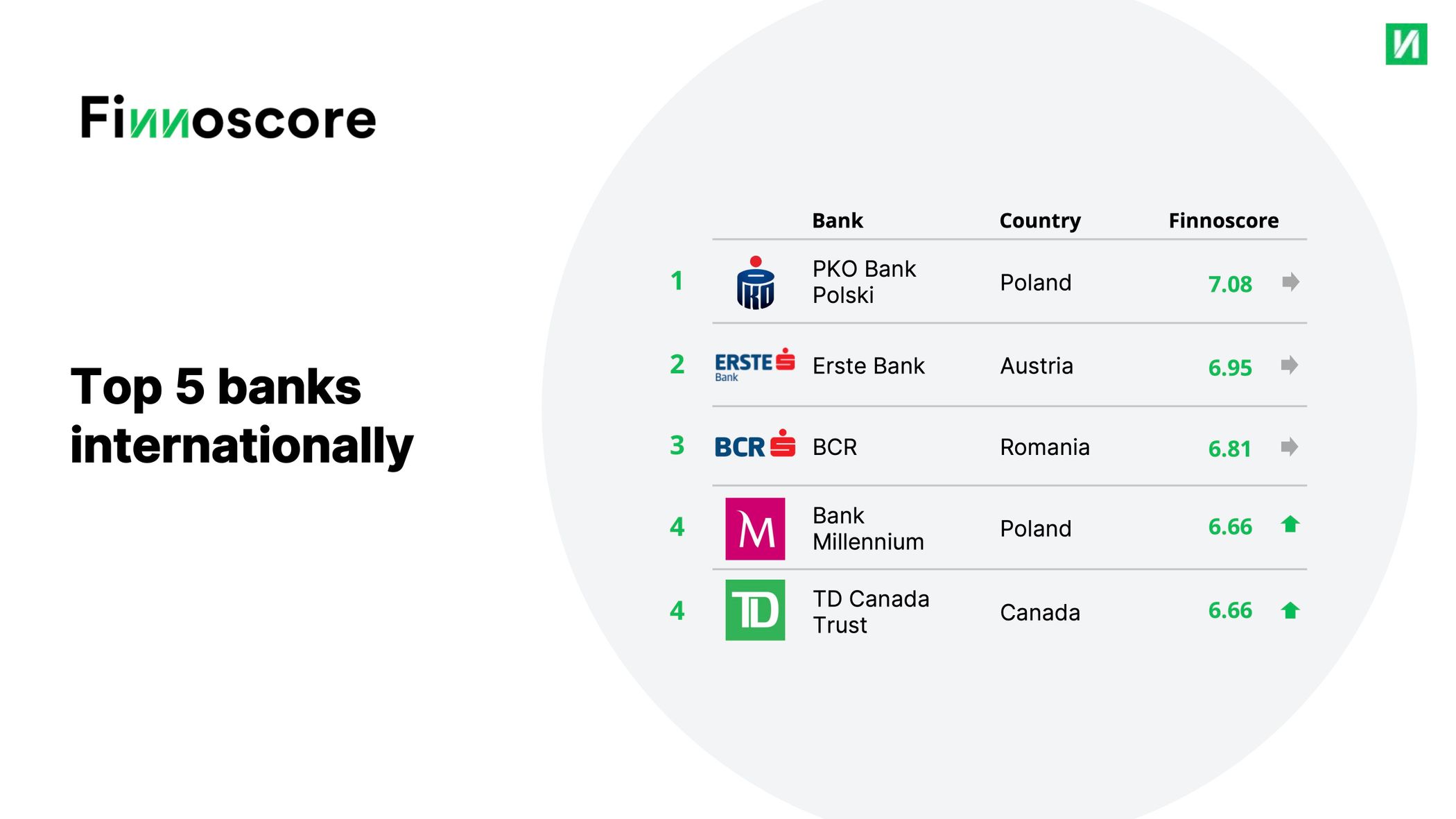

In this year's edition of the Finnoscore, many of the top performers from last year were able to defend their excellent positions, but new banks from Poland and Canada have joined the top 5. In 2023, traditional banks will mainly show a broader range of omnichannel interaction capabilities and will be able to hold their own alongside neobanks.

Download the entire study as a PDF file and learn even more insights, including:

- Detailed rankings

- Key lessons

- Winners and losers

- Backgrounds

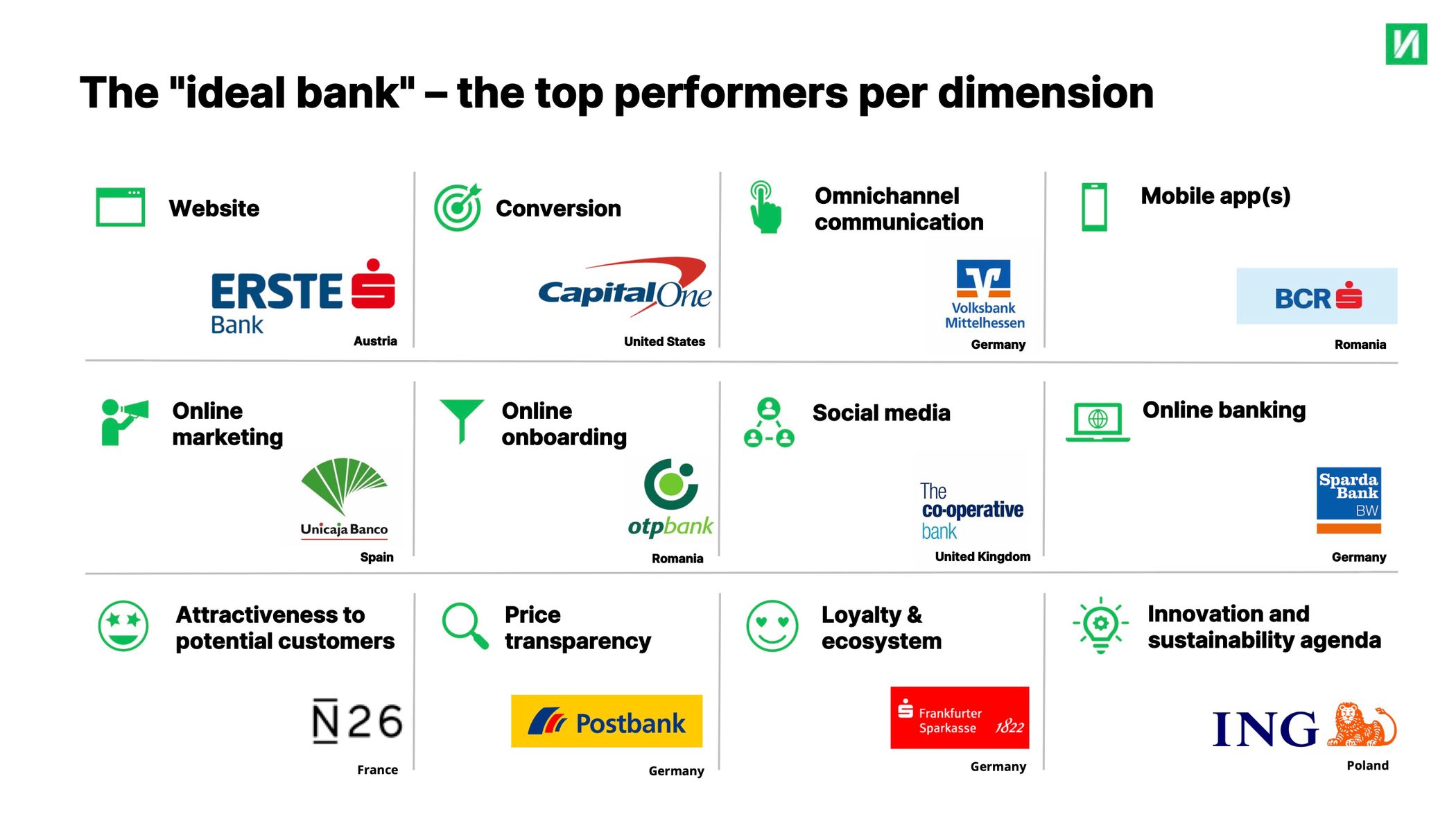

Individual features such as great, new online banking or a user-friendly website don’t make a lot of difference if they’re not embedded in a larger whole. Finnoscore Retail Banks 2023 is crystal clear here: those who consistently take a holistic approach have moved up; those who are merely cosmetic or piecemeal have lost places.

These are the winners and losers of Finnoscore 2023:

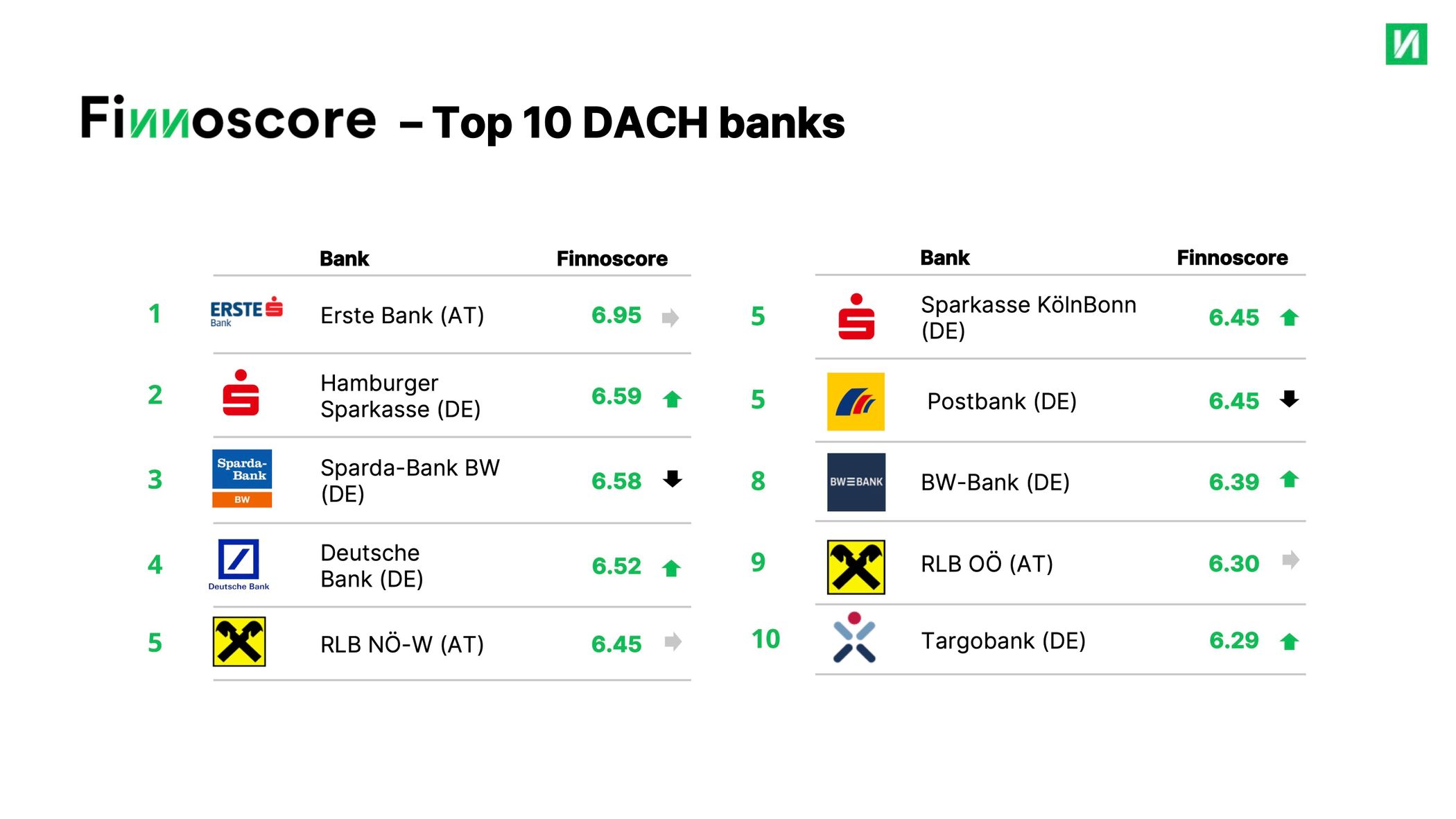

Germany and Austria share the top 10 ranks in the DACH region.

Austria's Erste Bank is once again the winner in the DACH region this year and also managed to hold its own internationally in second place out of more than 230 banks. This year, not a single bank from Switzerland made it into the top 10.

Erste Bank was able through its increased focus on website, omnichannel communication and online banking to maintain its position in first place.

At top 10 in the DACH region, BW Bank records the biggest rise of the year, gaining 6th place in the DACH ranking and 16th place in the international ranking.

Banks are adapting to new customer needs.

Bank customers are on the move and using communication and interaction channels more and more. Many banks are therefore placing a stronger focus on this new customer behaviour when revising their digital agenda in order to remain competitive. Some of these banks go one step further and enable their potential customers to use fully digitalised processes, including very easy-to-understand guidance, in order to become a customer as easily as possible.

Another trend that is already receiving more and more attention in other sectors is the topic of inclusivity. Parts of the analysed banks are also proactive here and invest in the areas of responsiveness and accessibility.

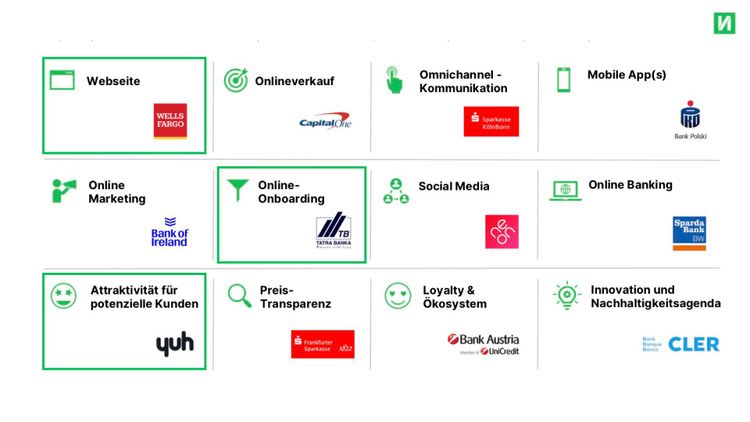

And finally, here’s an overview of all international and DACH winners of Finnoscore 2023:

.jpg)