Digital transformation in the insurance industry

The user-friendliness of websites is becoming increasingly important and is the most pronounced Finnoscore dimension for many institutions this year.

This year traditional insurance companies are performing slightly better on

average than their newer competitors in the insurance sector.

Detailed insights from 139 traditional insurers & neo-insurers based on 480 data points

Download the entire study as a PDF file and find out more about the analysis

and benchmark report on 139 insurers.

- Detailed rankings

- Key learnings and background information

- Building blocks for the “ideal digital” insurance provider

How do customers perceive the online presence of specific insurance companies?

Discover the industry-wide digital approaches currently in progress and gain a

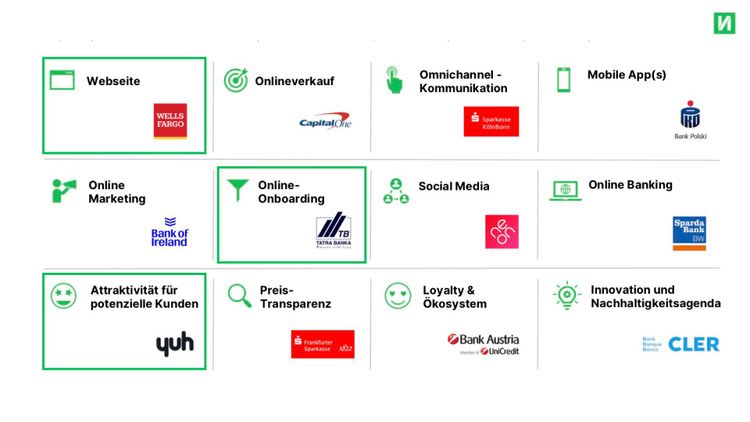

unique overview of the level of digitalisation in the insurance sector. The digitalisation measures are particularly evident in the dimensions of Website, Cybersecurity and Online Sales. This is also reflected in the Finnoscore among the Scandinavian newcomers (Scandinavian insurance companies are included in the Finnoscore sample for the first time), with Danish insurance companies leading in many categories. The top performers from Germany demonstrate outstanding performance in many of these dimensions, even making up 70% of the examples of

the “ideal digital insurance”.

We can also see an above-average performance from another member of the German-speaking region: Austria. Switzerland, on the other hand, has some catching up to do in some dimensions such as Website and Online Claims.

What lessons can you draw from Finnoscore Insurance Companies 2023 for the international insurance industry?

Learn from the best to optimise your own performance and the digital experience of your customers. We’ve put together the “ideal insurance” for you, with the top performers in each Finnoscore 2023 dimension:

Where do neo-insurers outperform traditional insurers?

Online Sales, Online Claim and Mobile Services are the areas in which new insurance companies have a stronger position. These new market participants are characterised, among other things, by improved price displays, customer rating options and options for concluding contracts online.

In the area Online Claims neo-insurers offer a greater variety and more important interaction options, such as uploading invoices and submission through a chatbot. This changes the entire user experience at this decisive moment and creates trust.

If you want to know how to best leverage these insights from the Finnoscore benchmarking for your bank or insurance company, contact us, we'll be happy to provide you with first hand insights.

.jpg)