Private banking focuses on the optimisation of various touchpoints along the user journey

Incremental improvements no longer cut it when it comes to remaining successful in the competition for digital customer interfaces.

The majority of providers exhibit annual improvement in a variety of dimensions such as online marketing, online onboarding, online services and omnichannel communication. This highlights the efforts of private banking providers to optimise the touchpoints along the entire customer journey rather than simply concentrating on incremental improvements.

Detailed insights from 43 private banking providers based on 320 data points

Download the full study as a PDF and find out more about the analysis and benchmark report on 43 established private banking providers.

- Detailed rankings

- Key lessons and background information

- Building blocks for the “ideal digital” private banking provider

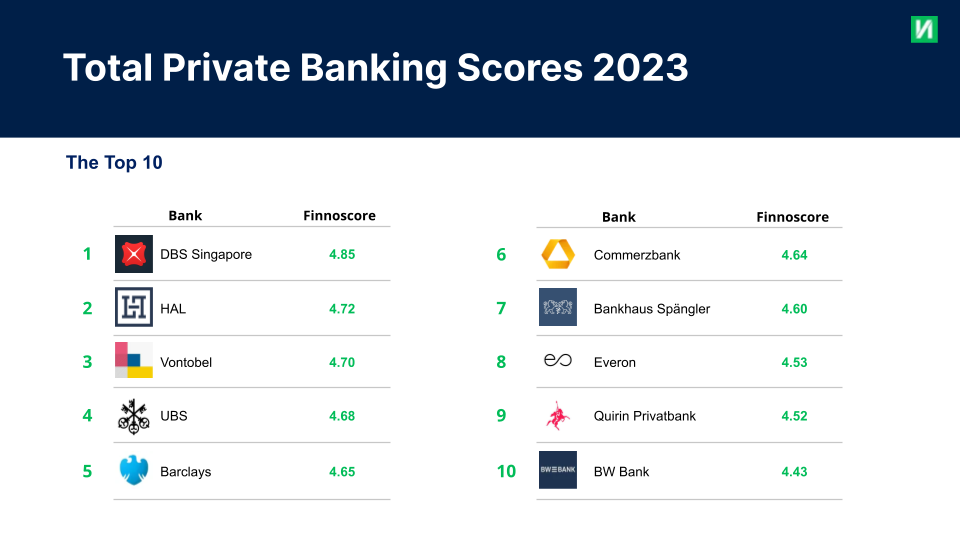

Who is the winner and who are the newly analysed private banking providers?

- 8 banks from Germany

- 3 banks from Switzerland

- 1 bank from Luxembourg

- 1 bank from Great Britain

- 1 bank from Austria

You can find out more about the new banks directly in the study itself.

Also new to the sample is Swiss company WealthTech Everon, joining the ranks in the area of B2C private banking. Everon was founded in 2019 and is the first fully digital independent Swiss private bank, explicitly tailoring its solutions to wealthy and affluent private individuals. Among other things, Everon focuses on an excellent user experience, cost optimisation and accessibility, according to co-founder Florian Rümmelein in an interview for PBI.

What insights can you draw from the Finnoscore private banking 2023?

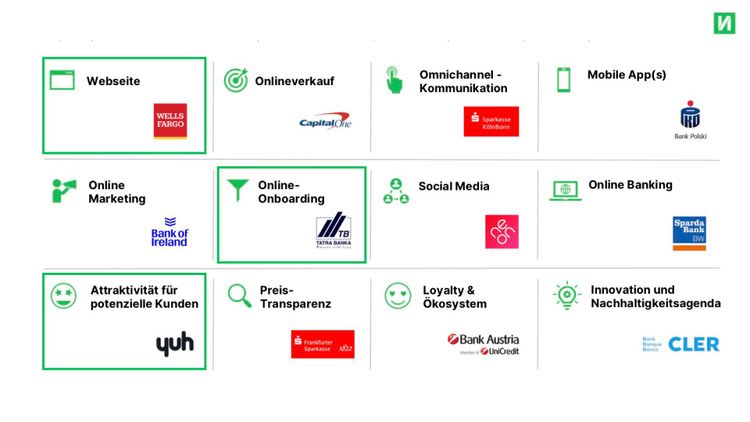

Learn from the best to optimise your own performance and the digital experience of your customers. We’ve put together the “ideal private banking provider” for you, with the top performers in the individual Finnoscore 2023 dimensions:

If you want to know how you can make the best use of these Finnoscore benchmarking insights for your bank, contact us and we will be very happy to provide you with first-hand insights.

.jpg)